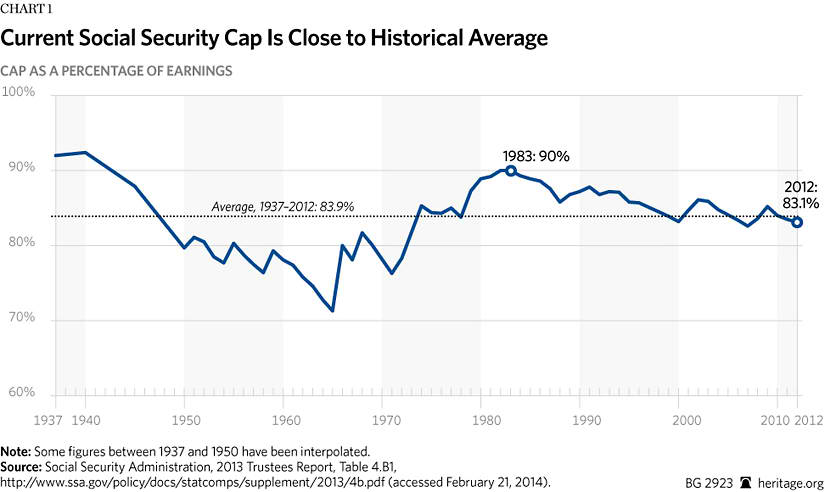

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

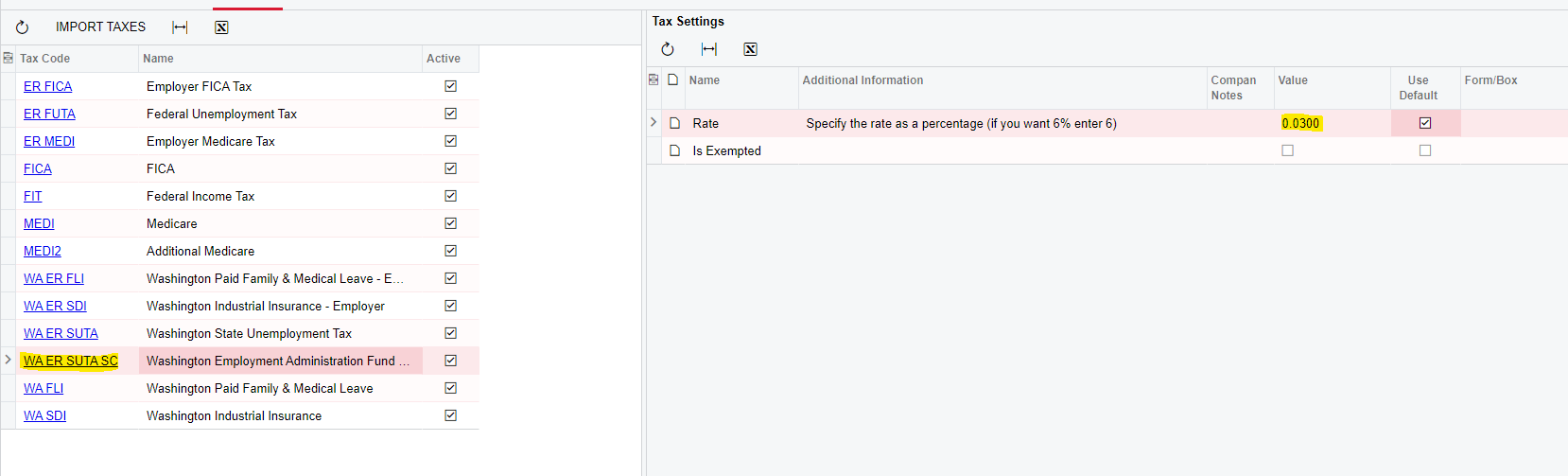

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes - YouTube

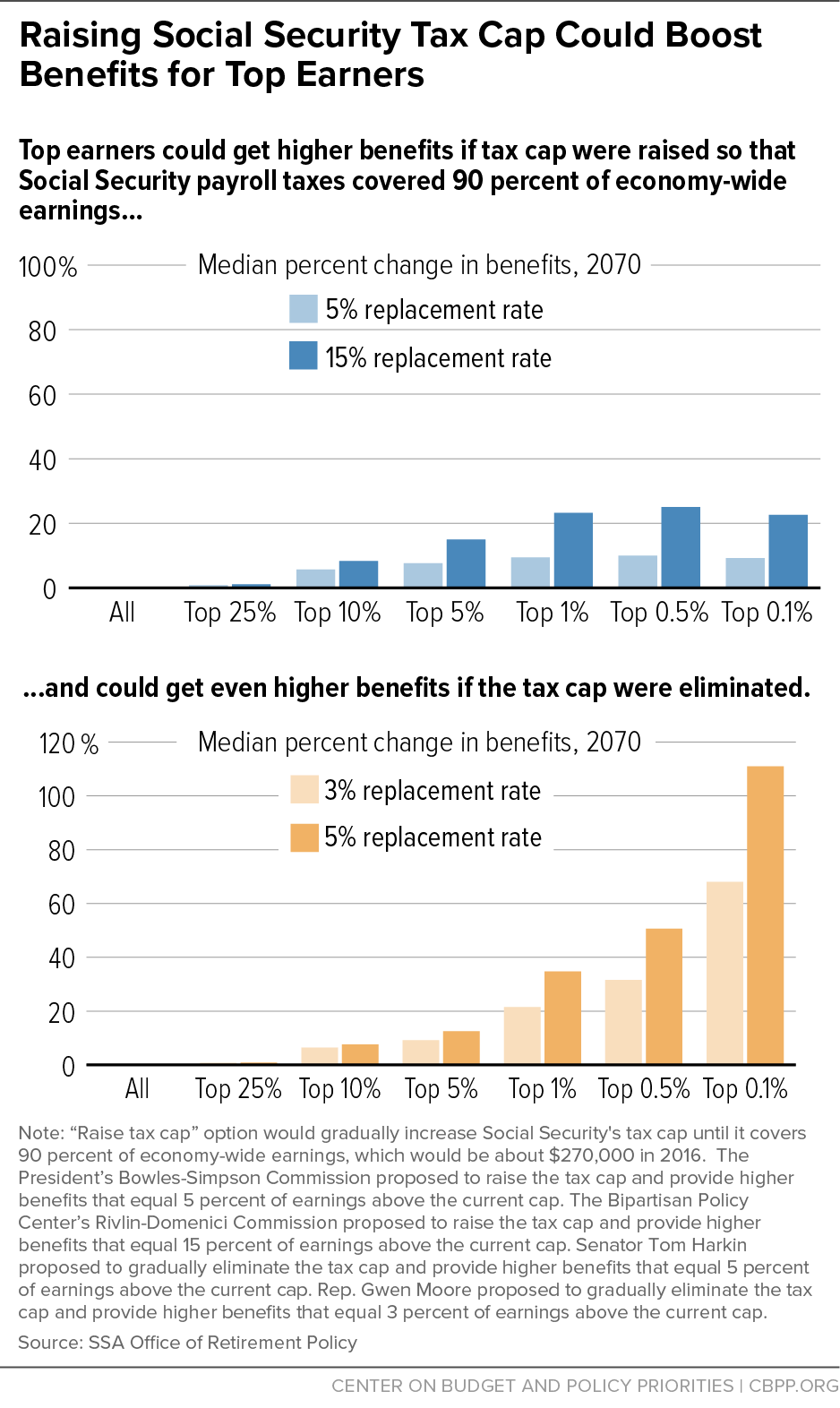

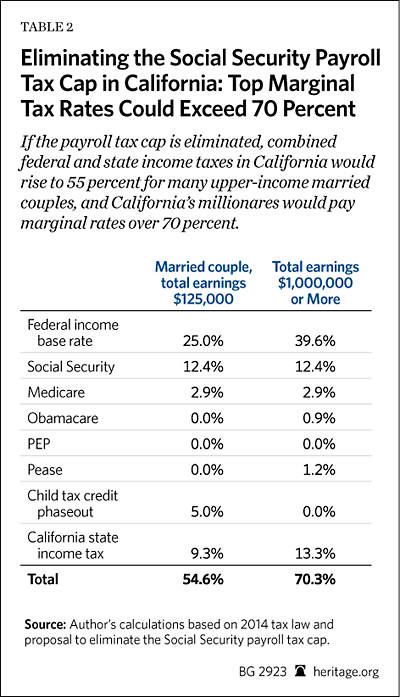

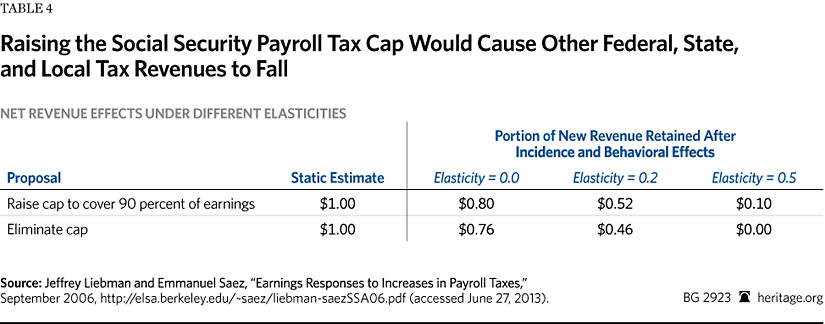

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

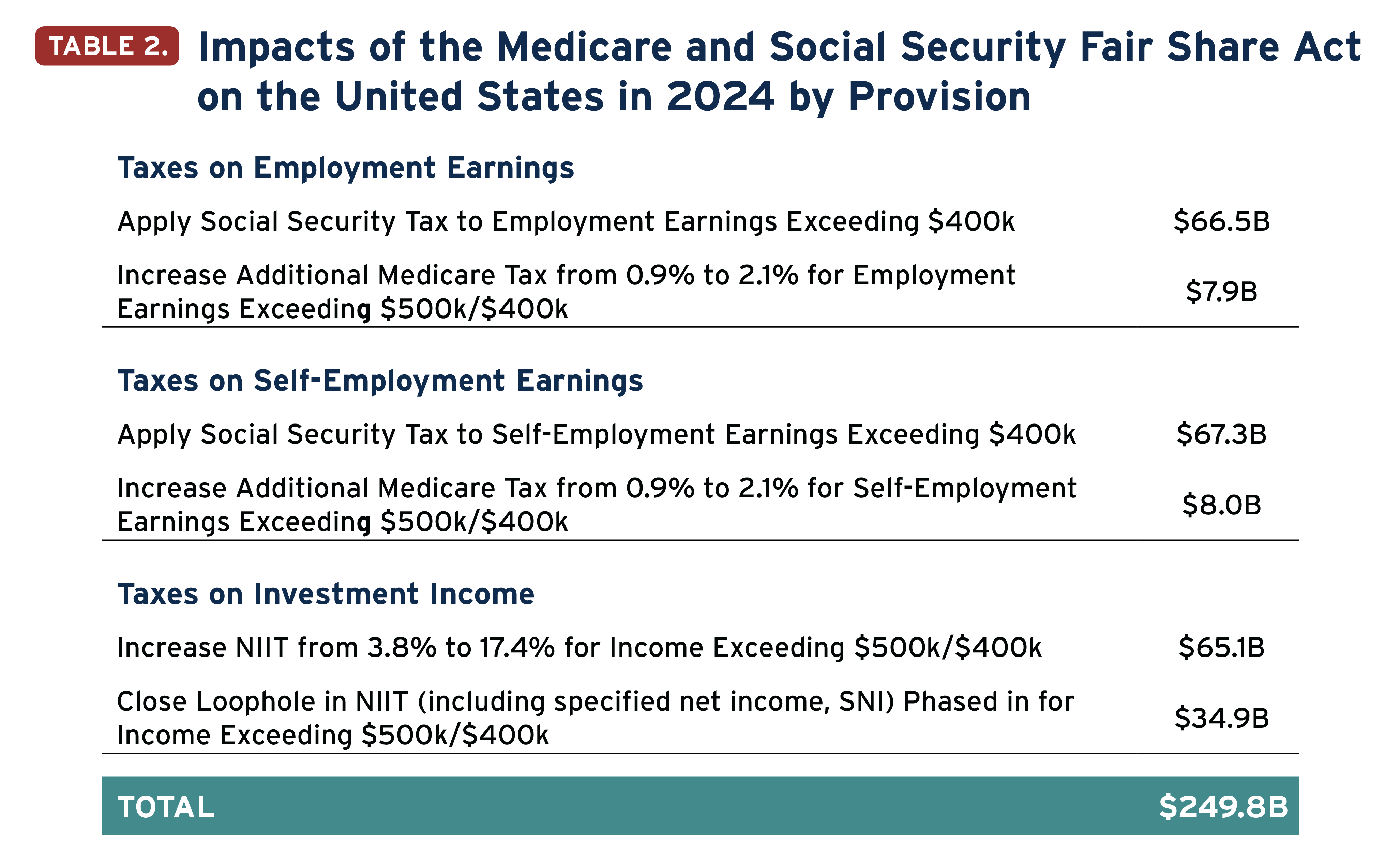

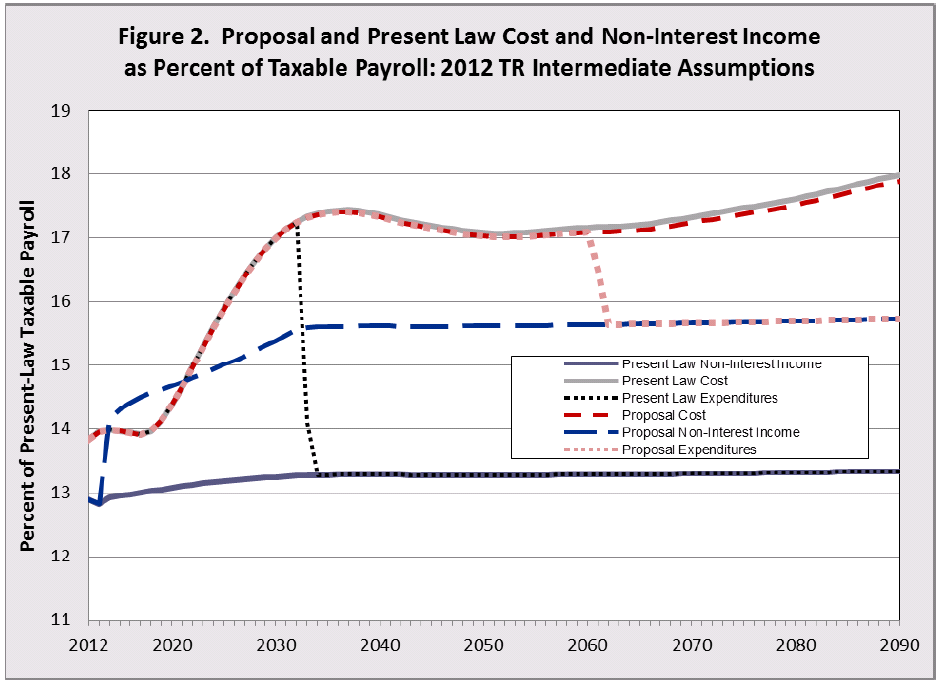

Could Eliminating the Payroll Tax Cap Extend Solvency to 2061 and Allow for Expanded Benefits? | Committee for a Responsible Federal Budget

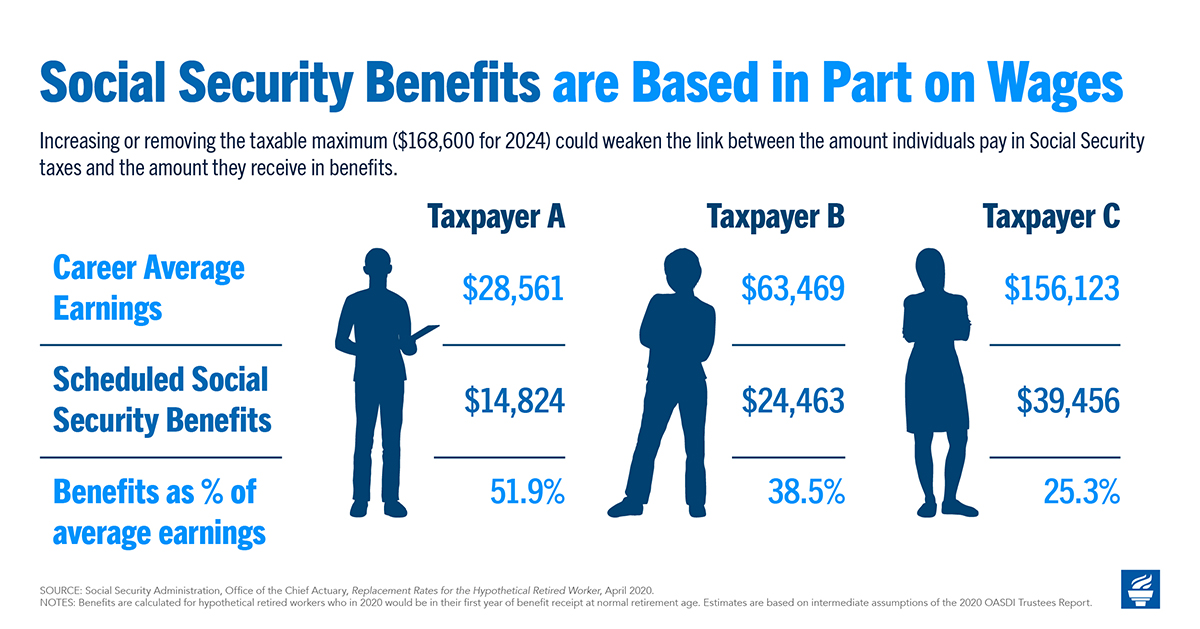

Scrapping the Social Security Payroll Tax Cap: Who Would Pay More? - Center for Economic and Policy Research

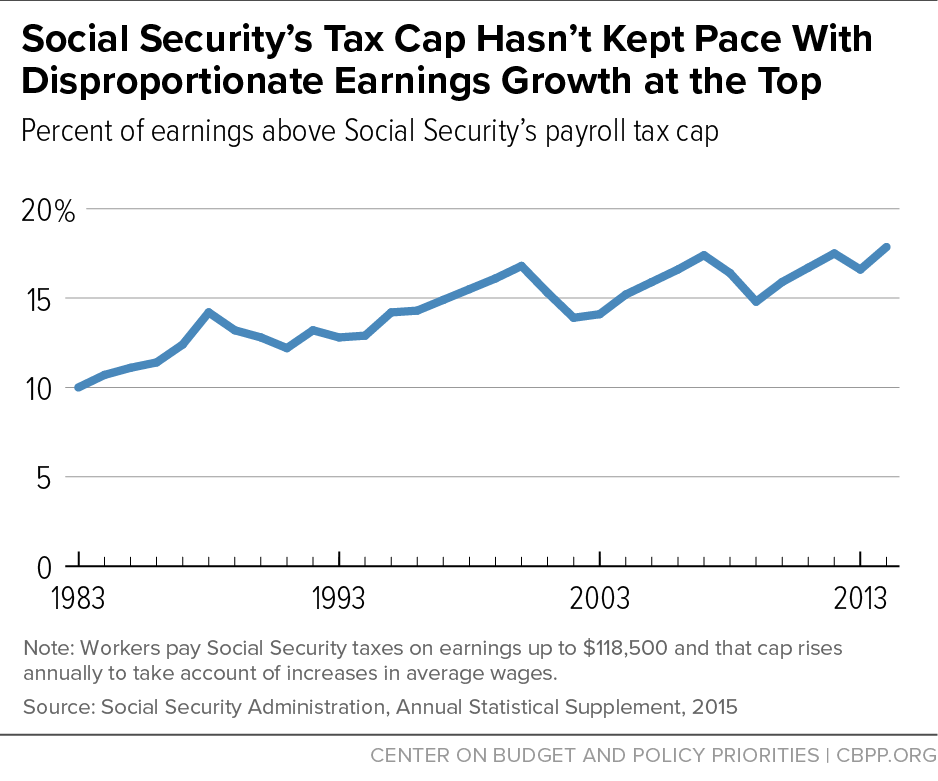

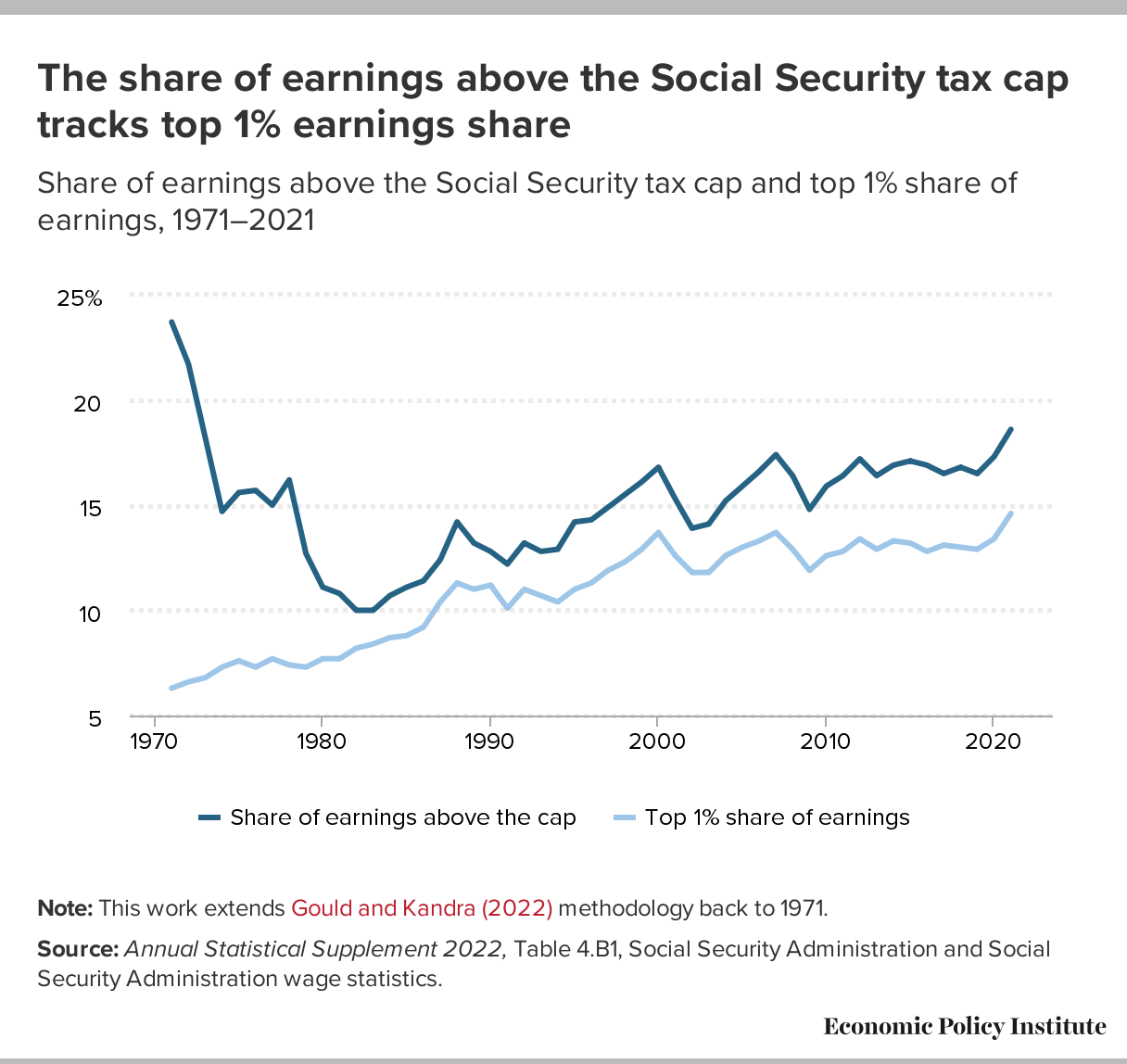

A record share of earnings was not subject to Social Security taxes in 2021: Inequality's undermining of Social Security has accelerated | Economic Policy Institute

Could Eliminating the Payroll Tax Cap Extend Solvency to 2061 and Allow for Expanded Benefits? | Committee for a Responsible Federal Budget